Personal loans are ideal when faced with a financial emergency or cash crunch. Obtaining a personal loan is now much simpler and quicker than it was ten years ago, thanks to the increasing number of financial institutions offering various types of personal loans. Today, many lenders offer you regular personal loans, instant personal loans, pre-approved personal loans, and pre-qualified personal loans. You can also apply for a personal loan using a loan app and get a fast loan, subject to meeting the essential criteria.

However, with so many options flooding the market choosing the right personal loan may be a daunting task. The personal loans offered by different lenders vary in their terms and conditions. Thus, before submitting your loan application, you must compare the different loan offers and find the one that best suits your needs. You can visit online loan comparison websites or download the best personal loan app to make the right decision.

Read on to discover a few expert tips to choose the right personal loan provider.

How to Choose the Best Loan Provider

Choosing the right personal loan provider is very important for a smooth borrowing experience. You must do thorough market research, compare the different loan terms, know your needs well and choose the lender that best fits your requirements. Here are a few things that you must consider before choosing your lender.

Check the Interest Rates

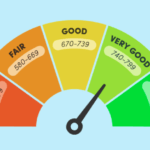

One of the most crucial things to consider when evaluating different lenders is the interest rates on personal loans. Different lenders charge different interest rates. Your CIBIL rating may also impact the interest rates. Due to the lack of security for personal loans, lenders frequently base interest rates on your CIBIL score.

You may negotiate for cheaper interest rates if you have an excellent credit score. Also, note that you might get a lower interest rate when availing the loan through a loan app because of their low operational costs.

Cross-check the total fees levied on your loan

When comparing the interest rates, you must also note the fees and charges levied by the lender on your loan. There are different charges associated with a loan. The most common are – processing fees, penalty fees, loan transfer fees, preclosure fees etc. Make sure your lender is not charging exorbitant amounts as this will impact your repayment.

You must also read the terms and conditions to discover all the conditions of your lender before signing the papers. Opting for a reputed lender reduces these risks. Personal loan apps also offer better transparency.

Consider the eligibility criteria

When looking for the best personal loan in the market, choose a lender with simple and straightforward eligibility criteria. This will quicken the verification and approval procedure. It also increases your chances of approval and meeting all the eligibility requirements allows you to negotiate a better deal.

The following are the general criteria for obtaining a personal loan:

- Age: 23 to 60 years.

- Employment Status: Salaried (working for a recognised trust, public or private limited business, government organisation, PSU, LLP, proprietorship, or partnership firm).

- Citizenship Status: Indian.

- Salary Limit: Rs. 20,000 or more.

Check the Processing time

A pre-approved or instant loan can be obtained more quickly than a standard loan. Existing customers with solid credit scores are typically eligible for these loans. If you haven’t availed a loan before then you can apply for an instant loan through a personal loan app.

Instant loans can be obtained in minutes or a few days, depending on the lender and your eligibility. However, depending on your credit history and the lender’s policies, standard personal loans can take up to 5 days to process.

Select a lender who offers you the necessary loan amount

A bigger loan amount necessitates a higher CIBIL score. Ask your lender if your present CIBIL score is sufficient to qualify you for the desired loan amount. Your total monthly income is another factor that affects the accepted loan amount. You can use a loan calculator to check your total loan eligibility. This calculator is available online or you can access it through a loan app.

Conclusion

A personal loan is one of the simplest types of loans that can be used for multiple purposes. It is an unsecured loan that does not require any collateral. Today, several lenders are offering personal loans in the market. Therefore, you must select the best personal loan provider for your needs when applying for a personal loan.

In addition to traditional forms of personal loans, you can also apply for instant loans using a personal loan app. An instant loan app includes information on the lowest and highest loan amounts you can obtain, as well as prospective repayment terms and the loan’s applicable interest rates. They also offer better transparency and flexibility for your loan.